Net sales, profit and financial position

Net sales in the Addtech Group rose by 18 percent during the financial year to SEK 5,200 million (4,418). For comparable units, the growth was 7 percent and acquired growth totalled 12 percent. Exchange rate changes had an adverse effect of 1 percent on net sales, corresponding to SEK 47 million, and an adverse effect of 1 percent on operating profit, corresponding to SEK 4 million during the year.

During the financial year, operating profit climbed by 24 percent to SEK 470 million (380) and the operating margin reached 9.0 percent (8.6).

The operating margin before amortisation of intangible non-current assets equalled 10.1 percent (9.6).

Net financial items were SEK -23 million (-16) and profit after financial items increased by 23 percent to SEK 447 million (364).

Profit after tax for the financial year rose by 23 percent to SEK 327 million (265) and EPS rose to SEK 14.65 (11.80). The effective tax rate was 27 percent (27).

At the end of the financial year, the return on equity was 34 percent (31) and the return on capital employed was 32 percent (33).

Return on working capital, P/WC (operating profit in relation to working capital), amounted to 53 percent (50). The long-term target in the Group and all units is for P/WC to exceed 45 percent. The P/WC profitability ratio encourages high operating profit and low levels of tied-up capital. When combined with the growth target of 15 percent, this provides conditions for profitable growth in the companies and Group. Average working capital, which for the calculation of P/WC comprises inventories plus net accounts receivable and accounts payable, reached SEK 890 million (753).

At the end of the financial year the equity ratio stood at 37 percent (40). Equity per share, excluding non-controlling interest, totalled SEK 46.20 (40.80). Consolidated financial net debt at the end of the year stood at SEK 534 million (358) and included pension liabilities of SEK 195 million (186). Net debt in relation to operating profit with reversed depreciation/amortisation (EBITDA) amounted to 0.9 (0.8). The net debt/equity ratio was 0.5 (0.4).

Cash and cash equivalents, consisting of cash and bank balances together with approved but non-utilised credit facilities, totalled SEK 717 million (655) at 31 March 2012. During the fourth quarter, the Group extended its available credit facilities by SEK 220 million.

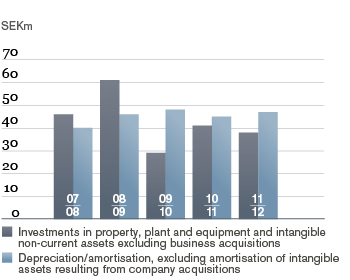

Cash flow from operating activities reached SEK 415 million (300) in the financial year. Investments in non-current assets were SEK 38 million (41) and company acquisitions, including settlement of additional purchase consideration for acquisitions implemented in previous years, totalled SEK 260 million (273). Disposal of operations totalled SEK 0 million (11), and disposals of non-current assets totalled SEK 2 million (1). The year's dividend amounted to SEK 156 million (111) and the repurchase of treasury shares totalled SEK 71 million (3).