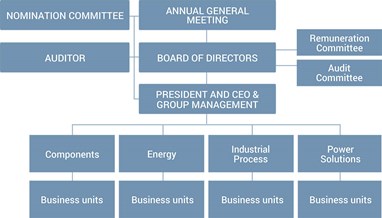

Corporate governance

Principles for corporate governance

The Addtech Group considers sound corporate governance to be an important foundation for achieving a confiding relationship with shareholders and other important stakeholders. The Swedish Corporate Governance Code, which is applied by the Addtech Group, aims to create a good balance between shareholders, the Board of Directors and senior management. Sensible corporate governance, with high standards for openness, reliability and ethical values, has always been a guiding principle for Addtech's operations.

Compliance with the swedish code of corporate governance

Addtech’s shares are traded on Nasdaq Stockholm and Addtech therefore follows the Nasdaq Stockholm Rule Book for Issuers. As a listed company Addtech also applies the Swedish Code of Corporate Governance (the Code), which is available at www.corporategovernanceboard.se. Deviations from aspects of the Code and justification for such deviations are stated where applicable throughout the text. The Company deviates on three points, two of which are included in the section on the Nomination committee and one in the section on Quarterly review by auditors. The Company's auditor has examined this corporate governance report. The Company’s URL is: www.addtech.com.

Compliance with applicable rules for trading

No violations of any applicable stock exchange rules occurred in 2016/2017 and Addtech’s operations were conducted in accordance with good practices in the stock market.

Shares and shareholders

The Addtech AB share register is maintained by Euroclear Sweden AB. As of 31 March 2017 Addtech had 4,791 shareholders according to the shareholder register and the total number of shares was 68,198,496 divided among 3,237,564 A shares, each carrying 10 votes, and 64,960,932 B shares, each carrying one vote. The total number of voting rights was 97,336,572. More information about the Addtech share and shareholders can be found in the annual report under the section the Share.

Key events in 2016/2017

On 15 July 2016, it was announced that Hans Andersén took office as new business area manager for Energy and joined Addtech's Group Management from 1 April. He succeeded Åke Darfeldt who retired.

On 31 August 2016, the resolutions adopted at Addtech's AGM were announced. These included approval of a dividend of SEK 3.25 per share, equivalent to a payout ratio of 55 percent, amounting to SEK 218 million. It was further resolved to introduce a long-term incentive programme in which participants are offered the chance to, at market price, acquire call options on repurchased shares in Addtech AB.

On 16 September 2016, it was announced that 300,000 class B shares had been bought back at an average price of SEK 132.00.

On 23 September 2016, it was announced that the share-related incentive programme, approved by the AGM in 2016, aimed at approximately 20 members of management comprising a maximum of 300,000 call options on repurchased class B shares, had been fully subscribed.

During the financial year 10 acquisitions were made, adding annual sales of about SEK 500 million.

Articles of Association

According to the Articles of Association, the Company's name is Addtech Aktiebolag and the financial year is from 1 April to 31 March. The Articles of Association have no special provisions about the appointment and dismissal of Board members and about amendments to the Articles. The Articles of Association do not limit the number of votes that each shareholder may cast at an Annual General Meeting. For the full Articles of Association, which the EGM adopted in their present form on 19 November 2013, please see the Company’s website under Investors/Corporate governance/Articles of Association of Addtech.

Annual General Meeting

Shareholder influence in the Company is exercised by the Annual General Meeting (AGM) or, where appropriate, an Extraordinary General Meeting, which is Addtech’s highest decision-making body. The AGM must be held in Stockholm within six months of the end of the financial year. The items on the agenda of the AGM for resolution include the election of the Board of Directors and the Chairman of the Board, the appointment of an auditor, the adoption of the income statement and balance sheet, the appropriation of the Company’s unappropriated earnings, the discharge from liability for the Members of the Board and the CEO, the Nomination Committee and its work, and remuneration guidelines for senior executives. Details of the company’s previous AGMs can be found on Addtech’s website, which also includes information on shareholders’ entitlement to raise matters for consideration at the AGM, and on when such requests for consideration should be received by Addtech. No special arrangements regarding the function of the AGM, due to any provisions in the Articles of Association or as far as is known to the Company due to shareholder agreements, apply in the Company. Most decisions at shareholders’ meetings are taken with a simple majority and for elections the candidate who receives the most votes in an election is considered to be elected. Certain decisions, however, such as amendments to the Articles of Association, require a qualified majority.

2016 Annual General Meeting

Addtech’s Annual General Meeting was held on Wednesday, 31 August 2016 in Stockholm. 93 shareholders were present at the AGM, in person or by proxy, representing 66.79 percent of votes and 55.09 percent of capital. Chairman of the Board Anders Börjesson was elected to serve as chairman of the AGM. All members of the Board and Group Management attended the AGM. Authorised public accountant George Pettersson, principal auditor for Addtech, and Authorised public accountant Jonas Eriksson were also present at the meeting. The decisions taken by the AGM were:

- Dividend of SEK 3.25 per share.

- Re-election of directors Anders Börjesson, Eva Elmstedt, Tom Hedelius, Malin Nordesjö, Ulf Mattsson and Johan Sjö. Kenth Eriksson was elected to serve on the Board of Directors. Anders Börjesson was elected Chairman of the Board. At the subsequent first meeting of the new Board following its election, Tom Hedelius was reappointed Vice Chairman of the Board.

- Re-election of registered auditors, KPMG AB, for a period of one year.

- Introduction of a long-term incentive programme in which participants are offered the chance to acquire, at market price, call options on repurchased shares in Addtech AB.

- Authorisation to the Board of Directors to repurchase, until the next AGM, up to the maximum number of class B shares that the Company’s holding of treasury shares at any given time does not exceed 10 percent of the total number of shares outstanding in the Company.

The other resolutions of the AGM can be seen in the complete agenda from the AGM, which is available along with other information about the 2016 AGM at www.addtech.com.

2017 Annual General Meeting

Addtech 2017 Annual General Meeting will be held Thursday 31 August at IVA in Stockholm. For additional information about the 2017 AGM please see the section called “Welcome to the Annual General Meeting” in the annual report, as well as Addtech’s website www.addtech.com.

Nomination committee duties

The Nomination Committee’s mandate from the Annual General Meeting is to evaluate the composition and work of the Board of Directors as well as to submit proposals to the AGM for the Chairman of the AGM, Directors and Chairman of the Board, remuneration to directors who are not employed by the company, election, where appropriate, of a registered auditing firm and auditors’ fees, as well as principles for election of members to the Nomination Committee. The members of the Nomination Committee receive no remuneration from the Company for their work on the committee. The committee had three meetings at which minutes were taken prior to the 2017 AGM. The complete proposals of the Nomination Committee to the AGM are presented in the notice to attend the meeting and on the Company’s website.

Composition of the nomination committee

The meeting decided that the following principles will apply until further notice. Consequently, the AGM does not decide on these principles and the Nomination Committee assignments annually, unless the principles or the assignments are to be changed. The Nomination Committee consists of representatives of the five largest known shareholders by vote at year-end (grouped by shareholdings on 31 December) and the Chairman of the Board, who was also tasked with convening the first meeting of the Nomination Committee. The Nomination Committee will appoint a Chairman among its members. The composition of the Nomination Committee shall be announced not later than six months before the AGM.

The following were thus chosen as of 31 December 2016: Åsa Nisell (representing Swedbank Robur), Martin Wallin (representing Lannebo Fonder), Johan Strandberg (representing SEB fonder), and Tom Hedelius and Anders Börjesson, Chairman of the Board. The composition of the Nomination Committee was disclosed in conjunction with the presentation of the interim report for the third quarter on 2 February 2017.

Two Nomination Committee members are Board members and are not independent of the Company's major shareholders, which deviates from the Code's rules 2.4 on composition of the Nomination Committee. If more than one Board member is included on the Nomination Committee, no more than one of them may be in a position of dependence in relation to the Company's major shareholders. The composition of the committee follows the principles set by the AGM. Anders Börjesson is chairman of the Nomination Committee and Board Chairman. This deviates from the Code's rules 2.4, which state that the chairperson of the Nomination Committee shall not be a Board member of the Company. In conjunction with its first meeting, the Nomination Committee also deemed it suitable that the committee chairperson should be the member who represents the largest group of shareholders and who has good knowledge of both the company and other shareholders.

| Members of Nomination Committee | ||

|---|---|---|

| Nomination Committee prior to 2017 AGM (appointed by the largest shareholders in terms of voting rights on 31 December 2016) | ||

| Name | Representing | Percentage of votes in percent, 2016-12-31 |

| Anders Börjesson (Chairman) | A-Shareholders | 15.5 |

| Tom Hedelius | A-Shareholders | 14.9 |

| Åsa Nisell | Swedbank Robur Fonder | 7.0 |

| Martin Wallin | Lannebo fonder | 6.6 |

| Johan Strandberg | SEB Investment Management fonder | 5.6 |

| Total | 49.6 | |

Board duties

The primary duty of the Board of Directors is to manage the Group’s operations on behalf of the owners in such a way that the owners’ interests in a long-term return on capital are optimally protected. The Board of Directors holds overall responsibility for Addtech’s organisation and management of Addtech’s business. It is responsible for the Group's long-term development and strategy, for continuously monitoring and assessing the Group's operations, and for any other task conferred by the Swedish Companies Act.

Composition of the board of directors

In accordance with the Articles of Association, the Board is to consist of at least three and at most nine members. The directors serve from the end of the AGM when they are elected until the end of the next AGM. There is no limit to the number of consecutive terms a director may serve on the Board. The 2016 AGM re-elected directors Anders Börjesson, Eva Elmstedt, Tom Hedelius, Ulf Mattsson, Malin Nordesjö and Johan Sjö and elected director Kenth Eriksson. Anders Börjesson was elected Chairman of the Board.

At the subsequent first meeting of the new Board following its election, Tom Hedelius was reappointed Vice Chairman of the Board. The members of the Board of Directors are presented in the Board of Directors section of the annual report and on the Company’s website.

Independence of the Board of Directors

Several different types of independence requirements apply to the Board of Directors and its committees. Addtech applies independence requirements taken from applicable Swedish legislation, the Swedish Code of Corporate Governance, and the rules of the Nasdaq Stockholm Stock Exchange. The Nomination Committee evaluates the Board’s independence ahead of the Annual General Meeting. All Board members are independent of the Company, apart from Johan Sjö, who is employed in the Company as the CEO. In addition to being independent of the Company, Eva Elmstedt, Kenth Eriksson and Ulf Mattsson are also independent of the Company's major shareholders. The Board has thus been assessed as complying with the requirement that at least two of the members who are independent of the Company are also independent of major shareholders.

Rules of procedure

The Board of Directors adopts written Rules of Procedure every year in accordance with the provisions of the Swedish Companies Act. The rules of procedure clarify the distribution of work between members of the Board, including its committees, the number of regular Board meetings, matters to be addressed at regular board meetings and duties as the Chairman of the Board. The Chairman shall organise and lead the work of the Board, be responsible for contacts with the owners regarding ownership issues and communicate shareholders’ views to the Board, ensure that the Board receives satisfactory information and decision support documentation for their work and verify that the Board's decisions are implemented. The Board has also issued written instructions specifying the details of financial reporting to the Board and the distribution of work between the Board and the CEO.

Duties of the Chairman of the Board

The Chairman is responsible for ensuring that the Board’s work is well-organised and conducted efficiently and that the Board fulfils its obligations. The Chairman monitors operations in dialogue with the Chief Executive Officer. The Chairman is also responsible for ensuring that other Board members receive the introduction, information and documentation necessary to maintain the high quality of the discussions and decisions, as well as for monitoring that the Board's decisions are implemented. The Chairman represents Addtech in ownership issues.

Work of the Board of Directors 2016/2017

According to the Board's rules of procedure, the Board is to meet in conjunction with presentation of the interim reports, at an annual strategy meeting and at the first post-election meeting of the new Board per year as well as on other occasions if required. The Board held nine meetings in 2016, three of which were before the 2016 AGM and six after the AGM. The following table shows attendance at Board meetings:

| Board member | Elected | Born | Board | Remuneration committee | Audit committee | Independent in relation to the Company | Independent in relation to major shareholders | Total compensation, SEK |

|---|---|---|---|---|---|---|---|---|

| Anders Börjesson (ordförande) | 2001 | 1948 | 9 (9) | 1 (1) | 2 (2) | Yes | No | 500,000 |

| Eva Elmstedt | 2005 | 1960 | 9 (9) | 2 (2) | Yes | Yes | 250,000 | |

| Kenth Eriksson 1) | 2016 | 1961 | 5 (5) | 2 (2) | Yes | Yes | 250,000 | |

| Tom Hedelius (vice ordförande) | 2001 | 1939 | 9 (9) | 1 (1) | 2 (2) | Yes | No | 380,000 |

| Ulf Mattsson | 2012 | 1964 | 9 (9) | 2 (2) | Yes | Yes | 250,000 | |

| Malin Nordesjö | 2015 | 1976 | 9 (9) | 2 (2) | Yes | No | 250,000 | |

| Johan Sjö 2) | 2008 | 1967 | 9 (9) | 2 (2) | No | Yes | - | |

| 1) Took over at 2016 Annual General Meeting | ||||||||

| 2) No fee is paid to directors who are employed at Addtech | ||||||||

All meetings followed an agenda, which was provided to members prior to Board meetings along with documentation for each item on the agenda. Regular board meetings usually last half a day to allow time for presentations and discussions. The Chief Executive Officer or his designee presents all matters relating to the operations of the Company and the Group. Other salaried employees in the Company take part in Board meetings to present certain issues or when otherwise deemed suitable. The Company's CFO is the Board Secretary and the secretary of the Nomination Committee. The Board discussed the following matters at its meetings:

- Approval of significant policies such as the Board’s rules of procedure, attestation policy, financial policy, Code of Conduct, insider policy, communication policy and dividend policy.

- Strategic direction and significant goals.

- Significant issues concerning optimisation of capital structure, financing, dividend, repurchase of treasury shares, investments, acquisitions and divestments of operations.

- Monitoring and control of operations, financial development, information provision and organisational issues.

- Review with and report from the Company’s external auditors. Review with auditors, without Group management's attendance, for evaluation of the CEO and Group management.

- Evaluation of the work of the Board of Directors. Every year, the Board Chairman initiates and oversees the evaluation.

- Approval of interim reports, year-end report and annual report.

Evaluation of the work of the Board

The Board conducts an annual evaluation of its work. Each year the Chairman initiates and leads the evaluation of the Board’s work. The purpose of the evaluation is to further improve working methods, dynamics, efficiency and working environment, as well as the main focus of the Board’s work. This evaluation also focuses on access to and the need for special expertise on the Board. The evaluation includes interviews and group discussions. In addition, the Chairman of the Board conducts individual discussions with each director. The evaluations were discussed at a Board meeting and also serve as a basis for the Nomination Committee’s work when proposing directors.

Remuneration committee

The remuneration committee elected by the Board of Directors consists of: Anders Börjesson (Board Chairman) and Tom Hedelius (Vice Chairman), and Johan Sjö as the reporting member. The remuneration committee draws up the 'Board's proposal for principles regarding remuneration to senior management'. The Board discusses the proposal, which is then presented to the AGM to decide on. The Board sets the remuneration of the CEO based on the AGM's decision. The CEO does not report on his own remuneration and does not take part in making the Board decision. The remuneration committee sets the remuneration of other members of Group management based on proposals from the CEO. The Board is informed of the remuneration committee's decisions. The remuneration committee then has the task of monitoring and evaluating application of the guidelines for remuneration to senior management as decided on by the AGM. In addition, the remuneration committee must monitor and evaluate ongoing programmes, and those completed during the year, for variable remuneration to the Company management. The remuneration committee had one meeting during the financial year.

Audit committee

The tasks of the Audit Committee are performed by the Board and conducted as an integral part of the Board’s work at its regular meetings. The Committee’s Chairman has knowledge of accounting and auditing. The role of the Audit Committee is to monitor the Company's financial reporting; to monitor the effectiveness of the Company's internal control and risk management regarding the financial reporting; to stay informed about the audit of the annual accounts and the consolidated financial statements; to assess and monitor the impartiality and independence of the auditor and in doing so to pay particular attention to whether the auditor provides the Company with other services besides auditing services; and to assist in drawing up proposals for the AGM's decision on selection of an auditor.

In conjunction with the adoption of the 2016/2017 annual accounts, the Board held discussions with the Company's external auditors and received their reporting. The Board also discussed matters with the auditors at this meeting, which was not attended by the CEO or other members of Company management.