Corporate governance

Principles for corporate governance

In addition to requirements stipulated by law or other ordinances, Addtech applies the Swedish Code of Corporate Governance (the Code). The Code is part of self-regulation in Swedish trade and industry and is based on the 'comply or explain' principle. This means that a company that applies the Code may deviate from certain rules but, if so, must provide an explanation and reason for each deviation.

Deviations from aspects of the Code and justification for such deviations are stated where applicable throughout the text. The Company deviates on three points, two of which are included in the section on the Nomination committee and one in the section on Quarterly review by auditors. The Company's auditor has examined this corporate governance report. The Company's website is: www.addtech.com.

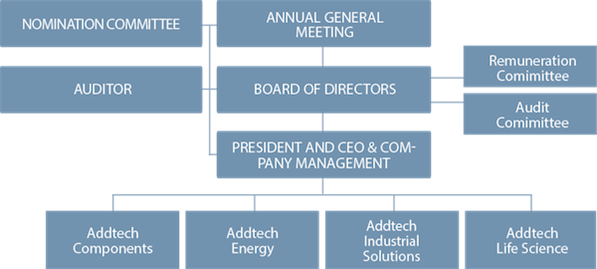

Distribution of responsibilities

The aim of corporate governance is to create a clear distribution of roles and responsibilities between owners, the Board of Directors, the Board's committees and executive management. Corporate governance at Addtech is based on applicable legislation, mainly the Swedish Companies Act, the stock exchange listing agreement with NASDAQ OMX Stockholm, the Swedish Code of Corporate Governance (the Code) and internal guidelines and regulations.

System for internal control and risk management in financial reporting

Internal control

The Board of Directors has overall responsibility for ensuring that the Group has an effective system for management and internal control. This responsibility includes annually evaluating the financial reports it receives and stipulating the content and format of these reports to ensure their quality. This requirement means that the financial reporting must fulfil its purpose and comply with applicable accounting rules and other requirements incumbent on listed companies. The CFO annually reports on the Group's internal control work to the Board.

Control environment

Addtech builds and organises its business on the basis of decentralised responsibility for profitability and earnings. Internal control in a decentralised operation is founded on a firmly established process for defining goals and strategies for each operation. Internal directives and Board-approved policies convey defined decision-making channels, powers of authority and responsibilities. The financial policy, reporting manual and instructions for each annual/quarterly accounts are the Group's primary financial policy documents. A Group-wide reporting system with related analysis tools is used in the Group's annual/quarterly accounts process. At a more comprehensive level, all operations in the Addtech Group must comply with the Group's Code of Conduct.

Risk assessment

Addtech has set procedures for managing the risks that the Board and Company management deem pertinent to internal control of financial reporting. The Group's exposure to several market and customer segments and the fact that operations are run in approximately 130 companies constitute a substantial distribution of risks. Risk assessments begin with the Group's income statement and balance sheet to identify the risk of material errors. For the Addtech Group as a whole, the greatest risks are linked to inventories and carrying amounts of intangible non-current assets related to business acquisitions.

Control activities

Control activities include transaction-related controls such as authorisation and investment rules and clear payment procedures, but also analytical controls performed by the Group controller function and the central finance and accounting function. Controllers and financial managers at all levels of the Group play a key role in creating the right environment for transparent and true financial reporting. This role places great demands on integrity, expertise and the capabilities of individuals.

Regular finance conferences are held to discuss current issues and safeguard effective sharing of knowledge and experience within the finance and accounting functions. The monthly review of results that is performed via the internal reporting system and is analysed and commented on internally by the Board is a key overall control activity. The review includes an evaluation of results compared to targets set and previous performance as well as a follow-up of key indicators.

A 'self-evaluation' of internal control issues is performed in all Group companies each year. The companies comment on how important issues were handled, such as business terms and conditions in customer contracts, assessments of customers' credit ratings, valuation and documentation of inventories, payment procedures, documentation and analysis of financial statements/closing accounts, and compliance with internal policies and procedures. An accepted minimum level has been set for critical issues and processes, and all companies are expected to meet this level. The responses of each company are validated and commented on by that company's external auditor in conjunction with the ordinary audit. The responses are then compiled and analysed, after which they are presented to business area management and Group management. The results of self-evaluation are taken into consideration in planning the self-evaluation and external auditing for the coming year.

In addition to the 'self-evaluation' work, a more in-depth

analysis of the internal control in about 25 operating companies

takes place each year. This is classed as 'internal auditing' and

is performed at the companies by business area controllers and

employees from the Parent Company's central finance and accounting

function. This audit work involves charting and testing the

companies' key processes and control points in such processes. The

external auditors study the records kept of the internal audits in

conjunction with their audit of the companies. The process provides

a good foundation on which to chart and assess the internal control

in the Group. KPMG also performs an annual review and assessment of

the Group's internal control process.

Follow-up, information and communication

The Board receives monthly comments from the CEO regarding the business situation and development of operations. The Board reviews all quarterly reports and the annual report before their publication. The Board is updated annually about the internal control work and its results. The Board also examines the assessment made by KPMG of the Group's internal control processes.

The Group CFO, Group controller and business area controllers analyse the outcome of the internal control each year. An assessment is made of the improvement measures that are to be implemented in the various companies. The boards in the Group companies are informed of the outcome of the internal control in each company and the improvement measures that should be implemented. The business area controllers and company boards subsequently follow up this work on a continual basis during the following year.

Governance guidelines, policies and instructions are available on the Group intranet. The documents are regularly updated as needed. Changes are communicated separately via email and at meetings for controllers and financial managers.

Access to the documents for internal information on the intranet is governed via levels of authorisation. The Group's employees are divided into different groups and the groups have various levels of access to information. All financial guidelines, policies and instructions are available for each company's managing director and financial manager, business unit managers, business area managers, business area controllers and the central finance and accounting function. Access to financial data for the Group is also governed centrally via levels of authorisation.

Internal auditing

In light of the above risk assessment and structure of control activities, including self-evaluation and a more in-depth analysis of internal control, the Board has chosen not to have a separate internal auditing function.

Auditor

The Articles of Association stipulate that a registered auditing firm be selected as auditor. The 2013 Annual General Meeting elected KPMG to serve as the Company's auditor until the close of the 2014 Annual General Meeting. George Pettersson is the Auditor in charge, assisted by Jonas Eriksson. KPMG audits Addtech AB and practically all its subsidiaries.

The Company's auditor works according to an audit plan that includes comments from the Board and reports his or her findings to company managements and business area managements, Group management and the Board of Addtech AB. This takes place during the audit and when establishing the annual accounts. The Company's auditor also takes part in the Annual General Meeting, describing and commenting on his or her audit work.

The independence of the external auditor is regulated in a special directive decided on by the Board. It states the areas in which the services of the external auditor may be used regarding issues that are not part of regular auditing. KPMG continually assesses its independence of the Company and submits written affirmation to the Board each year stating that the auditing firm is independent of Addtech. In the past year, the auditors performed advisory assignments, mainly concerning accounting and taxation issues. The total fee for KPMG's non-auditing services totalled SEK 1 million during the 2013/2014 financial year and SEK 1.5 million during the preceding year.

Quarterly review by auditors

Addtech's six-month or nine-month reports were not reviewed by

Addtech's external auditors during the 2013/2014 financial year,

which deviates from the rules of the Code. Among other things,

after consultation with the Company's external auditors, the Board

has so far judged that the additional cost to the Company of

extended quarterly reviewing by the auditors cannot be

justified.

Ownership and shareholdings

Addtech is a public limited liability company and was listed on NASDAQ OMX Stockholm on 3 September 2001. The Company was previously part of the listed Bergman & Beving group. Data on owners and shareholdings are provided in the section on the Addtech share in the annual report. Anders Börjesson (with family interests) and Tom Hedelius are the only shareholders who have a direct or indirect shareholding in the Company that represents at least a tenth of the number of votes for all shares in the Company.

Limitations to voting rights

The Company's Articles of Association do not limit the number of votes that each shareholder may cast at an Annual General Meeting.

Articles of Association

According to the Articles of Association, the Company's name is Addtech Aktiebolag. Addtech is a public company. Share capital amounts to SEK 51,148,872. The number of shares is 68,198,496, of which 3,253,800 are Class A shares, entitling holders to 10 votes per share, and 64,944,696 are Class B shares, with one vote per share.

The Company's financial year is from 1 April to 31 March and the AGM is to be held in Stockholm. The Company's Articles of Association have no special provisions about the appointment and dismissal of Board members and about amendments to the Articles.

For the full Articles of Association, which the Extraordinary General Meeting on 19 November 2013 adopted in their present form, see the Company's website under Investors/Corporate governance/Articles of association of Addtech.

Annual General Meeting

The Annual General Meeting (AGM) is the highest decision-making body at which shareholders exercise their voting rights. The AGM makes decisions on the annual report, dividend, election of the Board (and auditor where applicable), remuneration to Board members and the auditor and other issues as per the Swedish Companies Act and the Articles of Association. More information about the AGM and the minutes are available on the Company's website. No special arrangements regarding the function of the AGM, due to any provisions in the Articles of Association or as far as is known to the Company due to shareholder agreements, apply in the Company.

The 2013 Annual General Meeting

Shareholders representing 54.4 percent of the share capital and 66.3 percent of the votes took part in the AGM on 28 August 2013. Anders Börjesson was elected Chairman of the meeting. The meeting's decisions included approving a dividend of SEK 2.67 per share and a share-based incentive programme. Johan Sjö, the Company's President and CEO, commented on the Group's operations, the 2012/2013 financial year, developments during the first quarter of the new financial year and the Group's outlook for the future.

Board members Anders Börjesson, Eva Elmstedt, Tom Hedelius, Ulf Mattsson, Johan Sjö and Lars Spongberg were re-elected. Anders Börjesson was elected Chairman of the Board. At the subsequent first meeting of the new Board following its election, Tom Hedelius was re-appointed Vice Chairman of the Board.

In accordance with the Board's proposal, the AGM authorised the Board of Directors to purchase and dispose of shares in the Company on one or more occasions during the period until the next AGM. The objective of repurchases is to allow for adaptation of the Group's capital structure, and also to enable the Company to pay for future acquisitions of companies or operations using the Company's own (treasury) shares. Holdings of treasury shares also enable the Company to fulfil its commitments in the share-based incentive programmes decided on at the AGMs in 2010, 2011, 2012 and 2013. Purchases shall be made on the NASDAQ OMX Exchange in Stockholm at a price within the range registered at any given time, which is the interval between the highest purchase price and the lowest sale price. Purchases of treasury shares are limited by the stipulation that the Company's total holding of treasury shares shall not exceed 10 percent of all shares in the Company at any time.

Disposal of the Company's treasury shares should be possible with or without preferential rights for shareholders, although not via NASDAQ OMX Stockholm. Disposals may take place to finance acquisitions of companies or operations.

At the first meeting of the new Board following its election, the Board of Directors of Addtech AB decided to utilise the authorisation that the AGM on 28 August 2013 granted to the Board to repurchase shares in the Company.

The 2013 AGM was held in Swedish and, in light of the ownership structure, simultaneous interpretation to other languages was not deemed necessary. All material for the meeting was available in Swedish and English. Due to the ownership structure, the minutes of the AGM are only available in Swedish.

Information about the 2014 AGM is available in the Shareholder information section of the annual report and on the Company's website.

2013 Extraordinary General Meeting

Shareholders representing 52.9 percent of the share capital and 64.4 percent of the votes took part in the Extraordinary General Meeting (EGM) on 19 November 2013. Anders Börjesson was elected Chairman of the meeting.

In accordance with the Board proposal, the EGM decided to carry out a split in the number of shares in order to achieve an appropriate number of shares in order to increase liquidity in the company's shares. The share split resulted in the number of shares in the company increasing through each share being split into three (3) shares. Following the split, the number of shares amounted to 68,198,496, of which 3,253,800 are Class A shares and 64,944,696 are Class B shares and each share has a quotient value of SEK 0.75. The Board was authorised to decide on the record date for the split and to take other necessary measures to carry out the share split.

The wording in the Articles of Association was changed to the following: "The number of shares shall be no less than sixty million (60,000,000) and no more than two hundred and forty million (240,000,000)."

The EGM was held in Swedish and no simultaneous interpreting into another language was deemed necessary in view of the composition of the company's ownership. All material referred to by the meeting was made available in both Swedish and English. In view of the composition of the company's ownership, the minutes of the meeting are only available in Swedish.

Board of Directors

Board structure

According to the Company's Articles of Association, the Board of Directors is to consist of at least three and at most nine members.

Since 2012, the Board of Directors has comprised the following members elected by the AGM: Anders Börjesson (Chairman), Eva Elmstedt, Tom Hedelius (Vice Chairman), Ulf Mattsson, Johan Sjö and Lars Spongberg. The members of the Board of Directors are presented in the Board and management section of the annual report and on the Company's website. All Board members are independent of the Company, apart from Johan Sjö, who is employed in the Company as the CEO. In addition to being independent of the Company, Eva Elmstedt, Ulf Mattsson and Lars Spongberg are also independent of the Company's major shareholders. The Board thus complies with the requirement that at least two of the members who are independent of the Company are also independent of major shareholders.

Board fees

In accordance with the AGM's decision, the fee to each of the

external Board members elected by the AGM amounts to SEK 250,000. The Chairman receives SEK 500,000 and the Vice Chairman receives SEK 380,000. Total Board fees amount to

SEK 1,630,000, as decided on by the

AGM.

Chairman of the Board

The task of the Board Chairman is to ensure that Board work is well organised and efficiently run and that the Board performs its duties. In particular, the Chairman is to organise and lead the work of the Board to create the best possible conditions for the Board's work. The Chairman shall also ensure that any new Board member undergoes requisite introductory training, as well as other training that the Chairman and member jointly deem suitable, that the Board members continually update and deepen their knowledge of the Company, that the Board meets when required and that it receives satisfactory information and background material for making decisions in its work. Additionally, the Chairman shall establish proposals for Board meeting agendas after consulting with the CEO, check that Board decisions are implemented and ensure that Board work is evaluated annually. The Chairman is responsible for contacts with the owners about ownership issues and for conveying owners' opinions to the Board.

Board duties

The Board of Directors annually establishes written procedural rules governing its work and internal delegation of Board duties, including Board committees, Board decision-making processes, Board meeting procedures and the work of the Chairman. The Board has also issued a directive to the CEO and a directive regarding financial reporting to the Board. The Board has adopted various policies for the Group's operations such as a Financial Policy, Investment Policy and Addtech's Code of Conduct.

The Board oversees the work of the CEO through continuous monitoring of operations during the year and is responsible for ensuring that the organisation, the management and the guidelines for managing Company affairs are appropriate, and that the Company has good internal control and effective systems for following up and controlling the Company's operations as well as for ensuring compliance with laws and regulations that apply to the Company's operations. The Board is also responsible for establishing, developing and following up the Company's goals and strategy, decisions on acquisitions and disposals of operations, major investments and the appointment and remuneration of Group management. The Board and the CEO are responsible for submitting the annual accounts to the AGM.

Board work is evaluated annually in a process led by the Board Chairman, and the nomination committee is informed of the result of the evaluation. The Board continually evaluates the CEO's work. This issue is specially addressed annually, and no one from Company management attends this evaluation. The Board also evaluates and decides on material assignments held by the CEO outside the Company if he has any such assignments.

Board work

According to the Board's procedural rules, the Board is to meet in conjunction with presentation of the interim reports, at an annual strategy meeting and at the first post-election meeting of the new Board per year as well as on other occasions if required. The Board held nine meetings during the financial year, of which four preceded the 2013 AGM and five followed it. The next table shows attendance at Board meetings.

| Board member | Elected | Board | Remuneration committee | Audit committee | Independent in relation to the Company | Independent in relation to major shareholders |

|---|---|---|---|---|---|---|

| Number of meetings | 9 | 1 | 1 | |||

| Anders Börjesson (Chairman of the Board) | 2001 | 9 | 1 | 1 | Yes | No |

| Eva Elmstedt | 2005 | 9 | 1 | Yes | Yes | |

| Tom Hedelius (Vice Chairman of the Board) | 2001 | 9 | 1 | 1 | Yes | No |

| Ulf Mattsson | 2012 | 9 | 1 | Yes | Yes | |

| Johan Sjö | 2008 | 9 | No | Yes | ||

| Lars Spongberg | 2001 | 8 | 1 | Yes | Yes |

The Company's CFO is the Board Secretary and the secretary of the

nomination committee. Other salaried employees in the Company take

part in Board meetings to present certain issues or when otherwise

judged suitable. The Board's work during the year addressed various

issues, for example concerning the Group's strategic development,

day-to-day operations, the earnings trend, the profitability trend,

business acquisitions, organisation, and the Group's financial

position.

Remuneration committee

The remuneration committee elected by the Board of Directors consists of: Anders Börjesson (Board Chairman) and Tom Hedelius (Vice Chairman), and Johan Sjö as the reporting member. The remuneration committee draws up the 'Board's proposal for principles regarding remuneration to senior management'. The Board discusses the proposal, which is then presented to the AGM to decide on. The Board sets the remuneration of the CEO based on the AGM's decision. The CEO does not report on his own remuneration and does not take part in making the Board decision. The remuneration committee sets the remuneration of other members of Group management based on proposals from the CEO. The Board is informed of the remuneration committee's decisions. The remuneration committee then has the task of monitoring and evaluating application of the guidelines for remuneration to senior management as decided on by the AGM. In addition, the remuneration committee must monitor and evaluate ongoing programmes, and those completed during the year, for variable remuneration to the Company management. The remuneration committee had one meeting during the financial year.

Audit committee

The Board has appointed an audit committee consisting of the Board members who are not employed by the Company, in other words, Anders Börjesson, Tom Hedelius, Eva Elmstedt, Ulf Mattsson and Lars Spongberg. The audit committee's tasks were integrated into Board work at the Board's regular meetings, so the Board Chairman also acted as Chair of the audit committee. The committee Chair has accounting and auditing knowledge.

Eva Elmstedt, Ulf Mattsson and Lars Spongberg are also independent of the Company's major shareholders and have accounting knowledge.

Without affecting the Board's responsibility and tasks in other respects, the audit committee shall monitor the Company's financial reporting; monitor the effectiveness of the Company's internal control and risk management regarding the financial reporting; stay informed about the audit of the annual accounts and the consolidated financial statements; assess and monitor the impartiality and independence of the auditor and in doing so shall pay particular attention to whether the auditor provides the Company with other services besides auditing services; and assist in drawing up proposals for the AGM's decision on selection of an auditor.

In conjunction with the adoption of the 2012/2013 annual accounts at the May 2013 Board meeting, the Board held discussions with the Company's external auditors and received their reporting. At this meeting, the Board also discussed matters with the auditors without the CEO or other members of Company management being present. A corresponding meeting was held in May 2014 for the 2013/2014 financial year.

Chief Executive Officer

Johan Sjö is the CEO of Addtech. He is presented in the Board and management section and on the Company's website.

The CEO heads the operations as per the requirements of the Swedish Companies Act and the frameworks set by the Board. In consultation with the Board Chairman, the CEO prepares requisite documentation for information and decisions prior to Board meetings, gives presentations and explains proposals for decisions. The CEO leads the work of Group management and makes decisions in consultation with other members of the management. Group management consists of Johan Sjö, Artur Aira, Anders Claeson, Åke Darfeldt, Håkan Franzen and Kristina Willgård. Group management regularly reviews operations in meetings chaired by the CEO. The members of Group management are presented in more detail in the Board and management section of the annual report and on the Company's website.

Operating organisation

The Group's operations are organised in four business areas: Addtech Components, Addtech Energy, Addtech Industrial Solutions and Addtech Life Science. The business is conducted through subsidiaries in Sweden, Denmark, Finland, Norway, the United Kingdom, Austria, Germany, Poland, Estonia, Latvia, Lithuania, Japan, China, Taiwan, Trinidad/Tobago, Turkey and the US. Each operating company has a board of directors, in which the company's managing director and employees in managerial positions from business areas or business units are represented. Within each business area the companies are organised in business units linked to product or market concepts. Each company's managing director reports to a business unit manager, who in turn reports to the business area manager. Each business area manager reports to the CEO of Addtech AB. The business areas and business units hold internal board meetings chaired by the CEO of Addtech AB and the managers of the business areas, respectively.

Acquisition of companies

Acquisitions are a key part of the Group's growth strategy, and since its listing in 2001 Addtech has acquired more than 80 companies. From a governance perspective it is important, in certain issues of significance to the Group, to integrate the acquired company directly in conjunction with the acquisition. This work starts before the takeover date, during the negotiation and analysis period. Immediately after the new ownership commences, the company's employees receive training in matters such as the Group's financial reporting, which enables consolidation in the Group's accounts right from the acquisition date. Other areas may consist of drawing up administrative routines to comply with the Group's established working methods, integration in the Group's insurance programmes, or training titled Vision and Corporate Philosophy, in which all employees receive the opportunity to learn about the Group's core values.

Nomination committee

The Annual General Meeting in August 2012 authorised the Board Chairman to establish a nomination committee for the 2013 AGM. The members were to be selected from representatives of the five shareholders known to the Company who controlled the largest number of votes at 31 December 2012, to serve with the Chairman on the nomination committee. The following were thus chosen: Marianne Nilsson (representing Swedbank Robur), Martin Wallin (representing Lannebo Fonder), Johan Strandberg (representing SEB fonder), Tom Hedelius, and Anders Börjesson (Chairman of the Board). For the AGM in August 2013, the nomination committee presented proposals for AGM Chairman, number of Board members, fees to Board members and auditors, candidates for Board members and Board Chair, and proposals for how to appoint the nomination committee in preparation for the AGM in 2014 and its tasks.

The committee had two meetings at which minutes were taken prior to the 2013 AGM. Addtech's Board Chairman provided the nomination committee with information on the Board's own evaluation. In its evaluation, the nomination committee stated that the Board was effective and that the competence required was represented on the Board.

The Board is responsible for costs linked to performance of the nomination committee's assignments. The members of the nomination committee receive no remuneration from the Company for their work on the committee. During the year the Company paid no costs linked to the nomination committee's assignments.

In August 2012, the AGM resolved that selection criteria and policies for appointing the nomination committee and its assignments shall not be decided annually by the AGM. Rather, the selection criteria and the procedure applicable in previous years shall apply until further notice unless changes need to be made.

The nomination committee comprises: Marianne

Nilsson (representing Swedbank Robur), Martin Wallin (representing Lannebo

Fonder), Johan Strandberg

(representing SEB fonder), Tom

Hedelius, and Anders Börjesson

(Chairman of the Board). Two nomination committee members are Board

members and are not independent of the Company's major

shareholders, which deviates from the Code's rules on composition

of the nomination committee. If more than one Board member is

included on the nomination committee, no more than one of them may

be in a position of dependence in relation to the Company's major

shareholders. The composition of the committee follows the

principles set by the AGM. Anders Börjesson is chairman of the

nomination committee and Board Chairman. This deviates from the

Code's rules which state that the chairperson of the nomination

committee shall not, without an explanation, be a Board member of

the Company. However, the Chairman knows the Company and other

shareholders well. In conjunction with its first meeting, the

nomination committee also deemed it suitable that the committee

chairperson should be the member who represents the largest group

of shareholders. The composition of the nomination committee was

disclosed in conjunction with presentation of the interim report on

11 February 2014.

The nomination committee is to present proposals for selection of an AGM Chairman, the number of Board members, fees to each of the Board members, candidates for Board members and the Board Chair, as well as choice of registered auditing firm and auditing fees. The proposals of the nomination committee to the AGM will be presented in the notice to attend the meeting and on the Company's website.

Contraventions

The Company has not contravened any regulations that apply to the stock exchange on which the Company's shares are listed for trading, nor has it contravened fair practice in the stock market.